Eskom's decision not to sign any further Power Purchase Agreements (PPAs), except with the current Preferred Bidders of Round 4.5, flies directly against the Department of Energy’s public commitment to expand and accelerate, not only the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP), but also the coal, gas and co-generation Independent Power Producer (IPP) programmes.

Eskom's stance - announced on July 21 - does not come as a surprise. CEO, Brian Molefe, complained earlier this year about the relatively high cost of renewable energy generated and energy being produced during low demand times. This was reiterated in a recent meeting we had with Eskom.

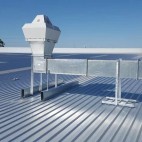

Eskom has also previously commented on the required grid upgrades necessitated in part by the fact that the majority of renewable energy projects are located in the remote and underserviced parts of the Northern and Eastern Cape.

What makes Eskom’s position baseless is that the issues they raise to back their argument have been, or are in the process of being, resolved:

- Over the four bidding rounds, the price of wind and solar PV renewable energy has been reduced to about 75c/kWh (albeit without the ability to store electricity during low demand periods and produce at peak periods). This is equivalent to the current cost of Eskom's new coal plant currently under construction. On a relative basis, renewable energy is expected to get cheaper. Renewable energy escalations are capped at CPI while the cost of coal power can and has previously escalated to above inflation rates.

- Solar PV and wind are not the only technologies that produce out of peak periods - so does coal. Coal power plants generate power relatively consistently during the day which means that power is generated during low-demand periods as well. Eskom already has established systems in place to address these issues. Pumped storage systems are used to pump water uphill during low-demand periods and release it through hydro generators during peak periods. The latest to be commissioned is the 1,333 MW Ingula system and the first two (out of four) generators were connected to the grid in March 2016.

- A further indication that the argument that “renewables produce energy during low-demand periods when additional generation is not required” is flawed is the fact that load shedding stopped during the same period that the Round 1 and 2 projects started to connect to the grid. This implies that renewables had a part to play in stabilising electricity supply.

- Eskom and the Department of Public Enterprise have recognised that the grid needs to be upgraded. In fact plans have been drawn up and construction has already started. In the Northern Cape, new substations and transmission lines are already being built. In addition, funding has been obtained from, among others, the African Development Bank and BRICS banks in the form of a R20bn and R2.6bn loan respectively. Eskom’s statement may however be their way of acknowledging that the grid works simply cannot keep up with the pace at which REIPPPP is growing

REIPPPP has not only been the government’s most successful procurement programme, but has received global accolades as a model case study for how IPP procurement should be implemented. Over the past four years, a total of 92 projects have secured PPAs with a combined capacity of 6,327MW (equal to 15% of Eskom’s generation capacity). Not only has this resulted in nearly R200bn of capital investment, but these projects have been key in generating employment and business opportunities in remote rural towns. Additionally, each of these projects has committed a portion of its revenues for community upliftment through socially responsible investment projects.

It is our view that the Departments of Energy and Public Enterprise will take Eskom's "concerns" regarding IPPs seriously. The REIPPPP and more broadly the other IPP programmes are key to ensuring certainty of electricity supply, which is required for economic growth. As a result, we would expect Departments of Energy, Public Enterprise and Eskom to resolve these issues before the end of 2016 or sooner.

Eskom's stance may be nothing more than a political gameplay in an attempt to secure a larger electricity hike in the next round of NERSA electricity price determinations. Alternatively, given the ongoing delays by government in updating the long-term energy mix under its outdated 2010 Integrated Resource Plan, there may also be some political opportunism at play by Eskom in an attempt to promote other forms of energy procurement, such as the long-debated nuclear option. This is a form of energy that Eskom knows well given their historical investment in the Koeberg Nuclear station in the Western Cape and a field in which they already have skills and expertise.

Whatever the real reason for Eskom's position, it is undeniable that it will shake foreign developers' confidence in renewable energy projects in South Africa. Without a speedy resolution to this issue, developers will be disinclined to invest in the development of new projects due to the uncertainty this situation creates.

Given the electricity demands required in future to sustain a healthy and growing economy, SA requires additional base load capacity. This base load is most likely to come in the form of new build coal, nuclear and/or gas. Given SA’s coal-heavy energy mix as well as international environmental pressures against coal power, SA will need to procure additional nuclear and/or gas base load power. This procurement will need to follow the same transparent and competitive process as REIPPPP and a final decision will need to take into account all costs (including environmental and social costs).

Ultimately the Department of Energy is responsible for determining the long-term energy mix and power generation requirements of the country. It is incumbent on them to end the current vacuum and policy uncertainty around energy planning and procurement by updating their 20 year Integrated Resource Plan as soon as possible. Investors require clarity to ensure the continued success of government’s partnership with the private sector in rolling out future energy procurement programmes.