The uYilo e-Mobility Technology Innovation Programme (EMTIP) was launched on the 13th March 2013. The programme aims to fast track electric mobility introduction into SA and provide inclusive cooperation through all stakeholders across government, industry, academia, entrepreneurs and SMME’s.

Over the past 5 years, has the programme achived its goals set out upon its inception?

The programme has achieved success across its mandate of enabling, facilitating and mobilising the ecosystem for introduction of electric mobility into South Africa. As a state funded entity, an independent economic impact assessment was conducted in 2016 that provided results of 1.78 times the grant value contributed to GDP and contribution of 74 permanent jobs to the economy with 28% of the grant reaching new household income

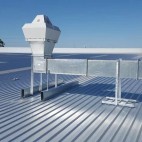

As a key facilitator of technologies of electric mobility, the facilities and expertise have been established that extended across nationally accredited battery testing, vehicle systems integration and a live testing environment that serves as a smart grid simulator.

These three facilities provide the pillars across the complete ecosystem of electric mobility technologies. The extended activities of the programme towards technology localisation have been facilitated through the Kick Start Fund that has enabled local innovators and SMME’s to accelerate their technologies towards a commercial product. These activities are key enablers to the development of the local electric mobility industry.

And what are future plan to increase the reach of this programme?

There have been strategic activities of the programme in the last year that have aligned to global developments and insights which have let to the formulation of the proposed planned interventions of the programme. These respectively span across enabling, facilitating and actively mobilising activities towards national integration, government lobbying (polices, regulations, financial and non-financial support), thought leadership, e-Mobility community cohesion and impact, and founding stronger industry linkages both local and international.

What are the types of skills being developed by uYilo Projects?

With the hosted of the programme by Nelson Mandela University, there is an active throughput by the programme in skills developed. These activities extend across technology tours, vocational training, internships, under-grad and post-grad research projects.

The pilot projects serves to bridge the gap towards potential social barriers with the technologies in order to increase local adoption rates as well as better understanding of the local ecosystem across potential challenges of large scale rollouts of such projects.

Nationally, extensive thought leadership initiatives have been active that span across conferences, workshops, think-tanks, seminars as well as the uYilo digital publications across key topics that are issued quarterly.

Is there enough awareness of electric vehicles, as well as sufficient policy and regulatory frameworks?

As an emerging market in South Africa, we still note some lack of awareness amongst the greater scope of consumers. With the radical acceleration of technologies in recent years, there are perceptions of electric vehicles being futuristic, however there are already commercially available globally.

Global electric vehicle stock reached 2 million at the end of 2016, of which between 2015 and 2016 an exponential increase of 1 million electric vehicles transpired, indicating a rapid introduction and uptake globally. In South Africa we acknowledge early market entrants of the Nissan Leaf (2013) and BMW i3 (2015), with possible new entrants from 2018 onwards being Jaguar, Audi and Volvo.

The local market development of approximately 400 100% electric vehicles sold to date has been early adopters despite the high import taxes and duties imposed on electric vehicles in South Africa, this towards the region of 40% total across Import and Ad Valorem excise duties which is a significant barrier to local adoption rates.

The activities of the Electric Vehicle Industry Association, towards which I represent as Secretariat, has submitted collaborative submissions to the International Trade and Administration Commission (ITAC) of the Department of Trade and Industry across reduction of the import duties in order to increase market adoption alongside the benefits of electric mobility that are not only environmental across air qualities within our cities, but also allow displacement of expensive fossil fuel imports towards more investment into local fiscus.

The 2030 South African National Development Plan is inclusive of critical actions towards environmental sustainability and resilience, along reducing greenhouse gas emissions, however short to medium term policies and regulations are still yet to be implemented.

What are the major benefits for electric vehicles and e-mobility?

In South Africa, the energy and transport sectors have been identified as the fastest growing source of greenhouse gas (GHG) emissions, where transport accounts for around 10,8% of National GHG emissions. Direct emissions specifically from the road transport sector account for 91,2%, mainly from the combustion of petrol and diesel (Department of Transport – Green Transport Strategy).

The introduction of eMobility will have significant benefits towards reducing national fiscal expenditure on expensive fossil fuel imports that can be offset to provide additional investment into the local economy. The savings on fuel imports can additionally be used to invest into the establishment of the local eMobility ecosystem that provides opportunity for local technology innovation alongside the opportunities of job creation.

What concerns do people have about e-mobility?

One of the social components about eMobility is across perceptions that a lot of these technologies are still perceived to be futuristic, however there is already a variety of eMobility products and services already commercially available in South Africa already -technology anxiety. Technology has accelerated radically over the last few years that the majority of people cannot believe that you can buy a 100% electric vehicle in South Africa.

Another concern is across range anxiety where consumers compare electric vehicles to having the required range as internal combustion vehicles (ICE). The dynamic is the EVs provide opportunistic re-charging – this towards a matter of convenience to charge your car rather than traditionally having to go to a fuel station to re-fuel. Opportunistic re-charging takes place during two main circumstances, one while consumers are sleeping, the cars are recharged and hence every morning cars are 100% charged when the consumer starts the day.

Secondly, while consumers are at work (majority between 9am to 3pm) there exists an opportunity to charge EVs. In this instance, when consumers leave work then the cars are again at 100% charge. The question now extends if majority of consumers really drive an average of 150km’s to get to work, or from work to home. It’s an awareness and then mind-shift that is required.

Who has the biggest part to play in changing some of these perceptions?

All stakeholders within the electric mobility ecosystem would have to play a part across consumer awareness. Efforts are required to communicate a better understanding of the whole benefits and models across eMobility. Media have a significant role to firstly understand the scope of eMobility in order to publish the various insights to consumers.

How is the electric vehicle market evolving?

Private sector has driven the local markets since initial introduction in 2013. Nissan SA introduced the Leaf into SA in 2013 and BMW SA introduced the i3 in 2015. The total sales between BMW and Nissan are now close to 400 in total (Lightstone auto provide the audited data). In terms of infrastructure developments, there are currently 100 public charge points nationally across 12 cities. While Nissan SA and BMW SA have signed a MOA across jointly rolling out charging infrastructure, BMW SA have significantly executed the local deployment of EV charge stations nationally. Shopping malls across major cities are also gaining interest towards EV charge points - V&A waterfront, Constantia Village, Melrose Arch and Menlyn Mall are such examples with EV chargers installed.

Electric vehicles are becoming the new trend in the auto world, however are they too costly for the South African market right now?

Within the current framework of taxation in SA, electric vehicles are slapped with a total taxation of 43% across import duty and Ad Valorem. This is a dis-incentive across promoting uptake of electric vehicles. While batteries within the electric vehicle are the highest cost component of the vehicle, batteries solely do not attract any duties in SA when imported. Vehicle OEMs in SA have indicated that any rebate offered from government on taxation will be passed onto the consumer, so should we have the reduction in import tariff’s this would be a significant boost to the industry.